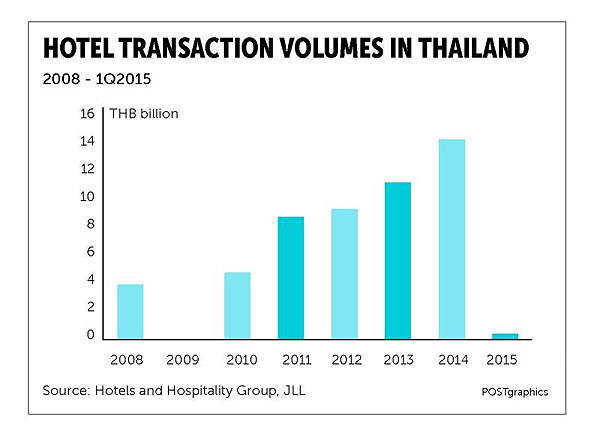

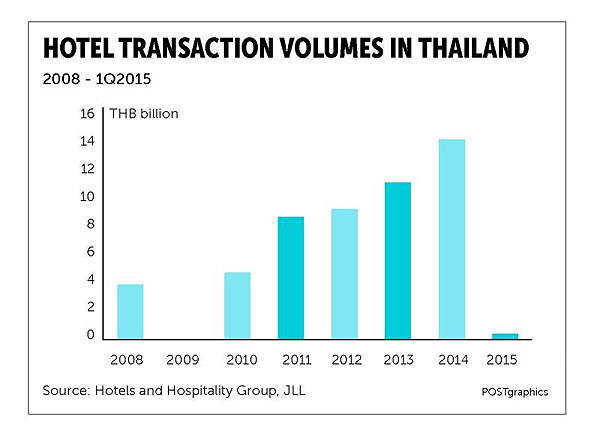

Thailand’s hotel investment market remains buoyant and attractive to both domestic and foreign real estate investors. It has improved steadily since the market slump during the global financial crisis that erupted in 2009. Transaction values tracked by the Hotels and Hospitality Group of JLL in Thailand reached 13.9 billion baht in 2014, or 5.7% of all hotel transactions in the Asia-Pacific region. The figures were an increase from 10.9 billion baht and 4.1% of the Asia-Pacific total the year before.

Investment destinations: Investors are interested in acquiring hotels in Thailand for a number of reasons, including lower capital values than in more developed markets such as Singapore or Hong Kong; relatively higher yield returns (whether at the outset of the investment or the opportunity for the incoming investor to add value), and the long-term prospects of Thailand’s tourism industry.

The initial investment destinations for investors tend to cover the main Bangkok, Phuket and Samui markets, followed by Chiang Mai, Pattaya, Khao Lak (Phangnga) and Krabi as secondary markets which are also attracting some investor interest.

Bangkok remains Thailand’s most popular hotel investment destination due to its position as one of the most visited cities in the world, attracting both leisure and corporate travellers all year round. Investor demand for assets in Bangkok has driven asset prices ever higher in spite of a significant amount of new supply of hotel rooms over the past few years, as evidenced by a transaction that JLL advised on in mid-2014 of a hotel in the prime Sukhumvit area.

Phuket has also proved to be an extremely buoyant market for resort transactions in recent years, with JLL having advised on nine resort deals worth a combined 14.8 billion baht. Investors are attracted to Phuket by the significant and growing number of direct flights available into Phuket International Airport (PIA) which insulates the market from disturbances in Bangkok.

For example, last year, when the Bangkok protests caused visitor arrivals to drop by 11.3% year-on-year compared with 2013, visitor arrivals to Phuket were less affected and even grew by a modest 0.2%, according to data from Airports of Thailand Plc. The expansion of PIA’s capacity, additional road infrastructure plus the ability to achieve a higher yield on investments when compared with Bangkok further adds to Phuket’s allure as one of Asia’s investment hotspots.

Finally, Samui can be described as the yin to Phuket’s yang, as limited flights and high airfares have shaped the market into a more “boutique” destination as opposed to the mass-tourism characteristic of Phuket.

The emergence of Surat Thani as a low-cost airport hub has, however, increased access to Samui and supported growth in the number of visitors to the island. This, combined with a limited supply of new hotels under construction (only one major resort opened on Samui last year), presents a favourable environment for investors in Samui. JLL now has a number of resorts in Samui that are being marketed for sale which have received strong interest from investors.

Investor profile: The numbers tracked by JLL show that from the start of 2012 to the present, 58% of the buyers of hotel properties in Thailand have been Thai investors and 40% have been international investors. By type, investors can be divided into:

– developers or property companies that buy with the intent of redevelopment.

– owner-operators who control hotel or serviced apartment brands and own the underlying assets they manage.

– funds that invest on behalf of international investors.

– corporate entities whose primary business is not hotel investments or,

– wealthy individuals or families.

On the buyer side, developers and property companies accounted for almost 60% of the total value of transactions recorded. Owner-operators were the second-largest group of investors representing more than 15%, followed by corporations (almost 12%). The combined value for investment funds and wealthy individuals or families was 10%.

On the other side of the table, sellers of hotel assets have typically been investment funds (35% of transaction value), developers and property companies (26%), corporate entities (11%) and wealthy individuals or families (10%).

Transaction characteristics: Investors look at a number of factors in assessing opportunities. Primarily, hotel investments are a function of purchase price versus existing or potential cash flow that can be generated from the hotel’s operations. For more passive investors, a certain yield expectation is applied to stabilised cash flows being generated by the target property, whether it is approximately 6-7% in Bangkok or slightly higher in the resort markets.

However, many investors acquire a property with a view to creating and extracting additional value, a strategy typically followed by developers and property companies. This might entail acquiring an existing asset to renovate, reposition, and/or appointing an international operator to manage the property, or adding additional rooms, among other strategies. Following such value enhancement, an investor can exit by selling the property to a passive investor or to one of the real estate investment trusts that have now become active investors in Thailand.

Thailand’s tourism prospects continue to be promising given the country’s already well developed infrastructure, strategic location and reputation as one of the world’s most popular holiday destinations. All these will continue to attract investors to the country’s hotel market in the foreseeable future. n

Karan Khanijou is a vice-president for investment sales at JLL’s Hotels and Hospitality Group. He has been a member of the team since 2011 and advised on nine billion baht worth of hotel and resort transactions. He can be reached at 02-624-6563. For more insights, visit www.jll.co.th.

Source: http://www.bangkokpost.com/property/news/563515/booming-hotel-market-beckons-investors-from-near-and-far